Improving FQHC Revenue Cycle Management in 2026

Federally Qualified Health Centers continue to play a central role in community based care and support large numbers of patients who often have limited access to traditional health care. Demand for these services has continued to rise. According to the Health Resources and Services Administration, health centers served more than 32.4 million patients in the most recent reporting year.

As patient volume grows, financial pressures also increase. Many centers rely heavily on Medicaid and uninsured patients, which makes consistent reimbursement essential for daily operations. Revenue cycle management is therefore a critical function for every FQHC because it ensures accurate registration, clean claims, timely payment, and full compliance with federal requirements.

This blog explores the current challenges in FQHC revenue cycle management and highlights the opportunities that can strengthen financial performance in 2026.

Key Takeaways

- FQHC revenue cycle management is more complex than standard medical billing because it must follow PPS encounter rules, sliding fee discount requirements, and a varied payer mix.

- Financial sustainability depends on accurate documentation, complete claims, and consistent reporting for both reimbursement and federal grants.

- Common challenges include documentation gaps, manual coding, limited system integration, and high administrative workload.

- Best practices such as stronger intake, routine audits, pre submission review, and performance tracking help reduce denials and improve stability.

- Automation offers major opportunities for improvement, especially in coding review, documentation accuracy, income verification, and claim readiness.

- RapidClaims tools support FQHC teams with automated coding assistance, documentation checks, denial prevention, and improved claim quality.

Table of Contents:

- What Is FQHC Revenue Cycle Management

- Why Revenue Cycle Management Is Critical for FQHCs

- Common Challenges in FQHC Revenue Cycle Management

- Best Practices for Improving FQHC Revenue Cycle Performance

- Technology’s Role in FQHC Revenue Cycle Management

- Outsourcing vs In House RCM for FQHCs

- Key Metrics Every FQHC Should Track

- Opportunities to Improve FQHC RCM in 2026

- Conclusion

- FAQs

What Is FQHC Revenue Cycle Management

Federally Qualified Health Centers are community based clinics that receive federal support to provide primary and preventive care in underserved areas. These organizations must follow specific federal requirements related to patient access, service scope, quality reporting, and community representation on their governing boards.

FQHC revenue cycle management refers to the complete set of activities that ensure the center receives accurate and timely reimbursement. These activities include:

- Patient intake and eligibility confirmation

- Verification of income for the sliding fee discount program

- Clinical documentation review

- Coding and charge capture

- Claim submission and payment follow up

- Compliance with federal and state billing requirements

How FQHC RCM Differs from Standard Medical Billing

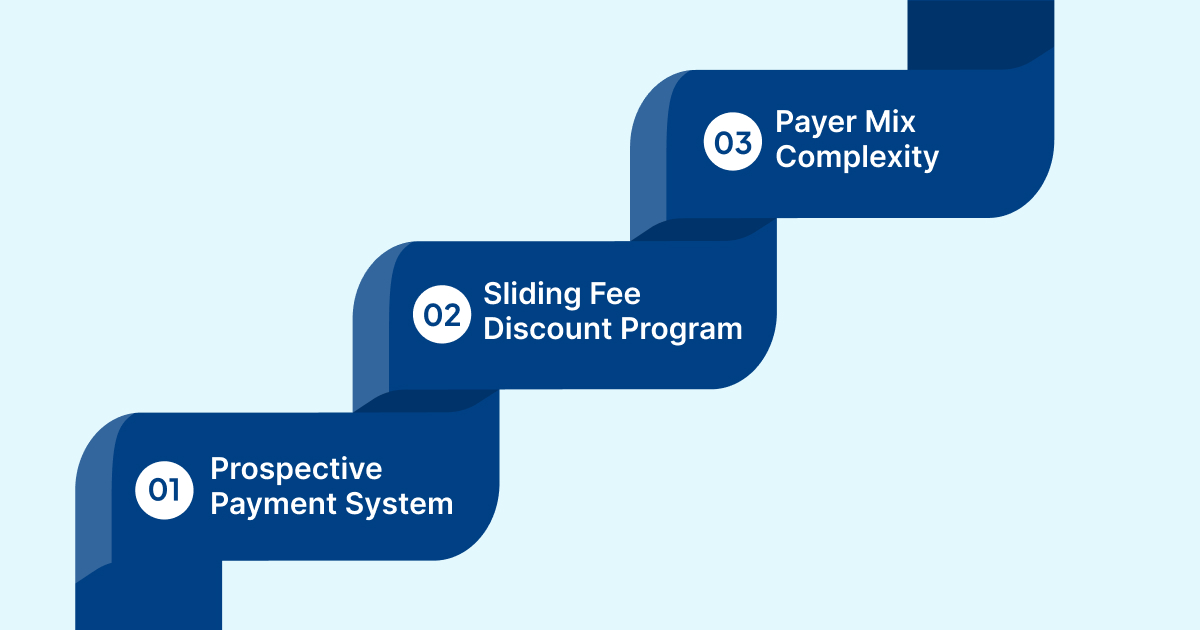

FQHC billing is more complex than typical outpatient billing because of unique payment and compliance rules:

- Prospective Payment System: FQHCs receive a fixed encounter rate under the PPS model rather than separate payments for each service. This requires correct documentation of qualifying encounters.

- Sliding Fee Discount Program: Patient charges must be adjusted based on verified income and family size. This adds extra administrative steps before claims can be processed.

- Payer Mix Complexity: Many patients rely on Medicaid or Medicare or have no insurance, which increases the amount of eligibility verification and manual follow up needed to secure reimbursement.

These factors make revenue cycle management a central operational function in every FQHC.

Why Revenue Cycle Management Is Critical for FQHCs

Strong revenue cycle performance is essential for the long term stability of every FQHC. Since most centers operate with limited margins, even small delays or errors in billing can affect their ability to maintain services and staffing.

1. Financial Sustainability

FQHCs depend on consistent reimbursement to support clinical operations, staffing, outreach services, and quality programs. Effective revenue cycle management ensures that all eligible encounters are billed correctly and that funds arrive on time.

2. Cost Pressures

Many centers face rising expenses related to staffing, technology, supplies, and compliance requirements. Efficient revenue cycle processes help offset these pressures by reducing avoidable write offs and administrative waste.

3. Reliance on Accurate Claims and Grant Reporting

FQHCs receive funding from both claims and federal grants. Accurate documentation and clean claims support both billing and required reporting for grant compliance. Errors in either area can reduce available funding.

4. Influence on Patient Access and Operational Stability

When revenue cycle performance weakens, centers may struggle with cash flow. This can limit hiring, delay service expansion, or reduce capacity. Strong revenue cycle operations help ensure that patients continue to receive timely and reliable care.

Must read: Future of Healthcare Revenue Cycle Management in 2026: Key Trends

Common Challenges in FQHC Revenue Cycle Management

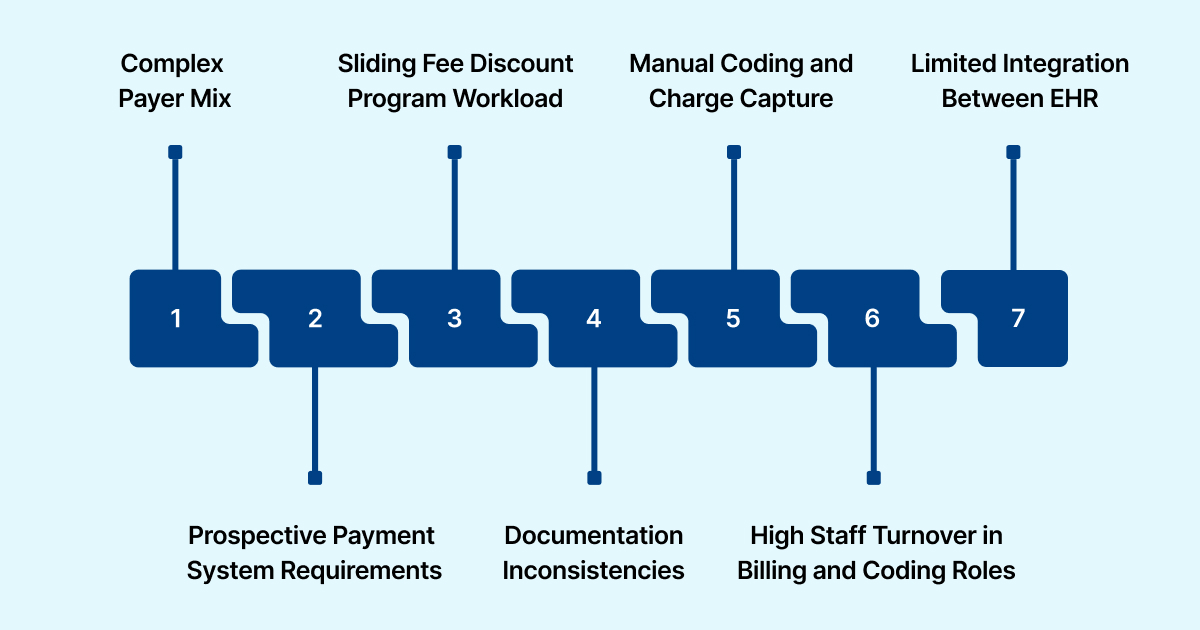

FQHC revenue cycle operations involve several steps that must work together smoothly. Many centers struggle with gaps that slow reimbursement, increase denials, or create administrative strain. The challenges below reflect the most common issues that affect financial performance.

1. Complex Payer Mix

FQHCs serve large numbers of Medicaid and Medicare patients and many individuals without insurance. Each group has its own rules, documentation needs, and verification steps. This creates more administrative work and increases the risk of claim errors.

2. Prospective Payment System Requirements

PPS reimbursement depends on accurate encounter documentation. If required details are missing, the encounter may not qualify for payment. This makes documentation quality and coding accuracy essential.

3. Sliding Fee Discount Program Workload

Centers must verify patient income and household size before assigning a discount level. This is a time-consuming process that affects billing if information is incomplete or outdated.

4. Documentation Inconsistencies

Busy clinical settings often lead to gaps in notes, missing signatures, or incomplete visit details. These issues slow coding and can trigger denials when claims are submitted.

5. Manual Coding and Charge Capture

Many FQHCs still rely on manual review of visit notes. This increases the risk of coding errors, missed charges, and delays in claim submission.

6. High Staff Turnover in Billing and Coding Roles

Community health centers often struggle to retain experienced billing staff. Frequent turnover disrupts workflows and reduces consistency in claims processing.

7. Limited Integration Between EHR and Billing Systems

Many FQHCs use systems that do not fully communicate with each other. This creates extra data entry work and increases the likelihood of errors.

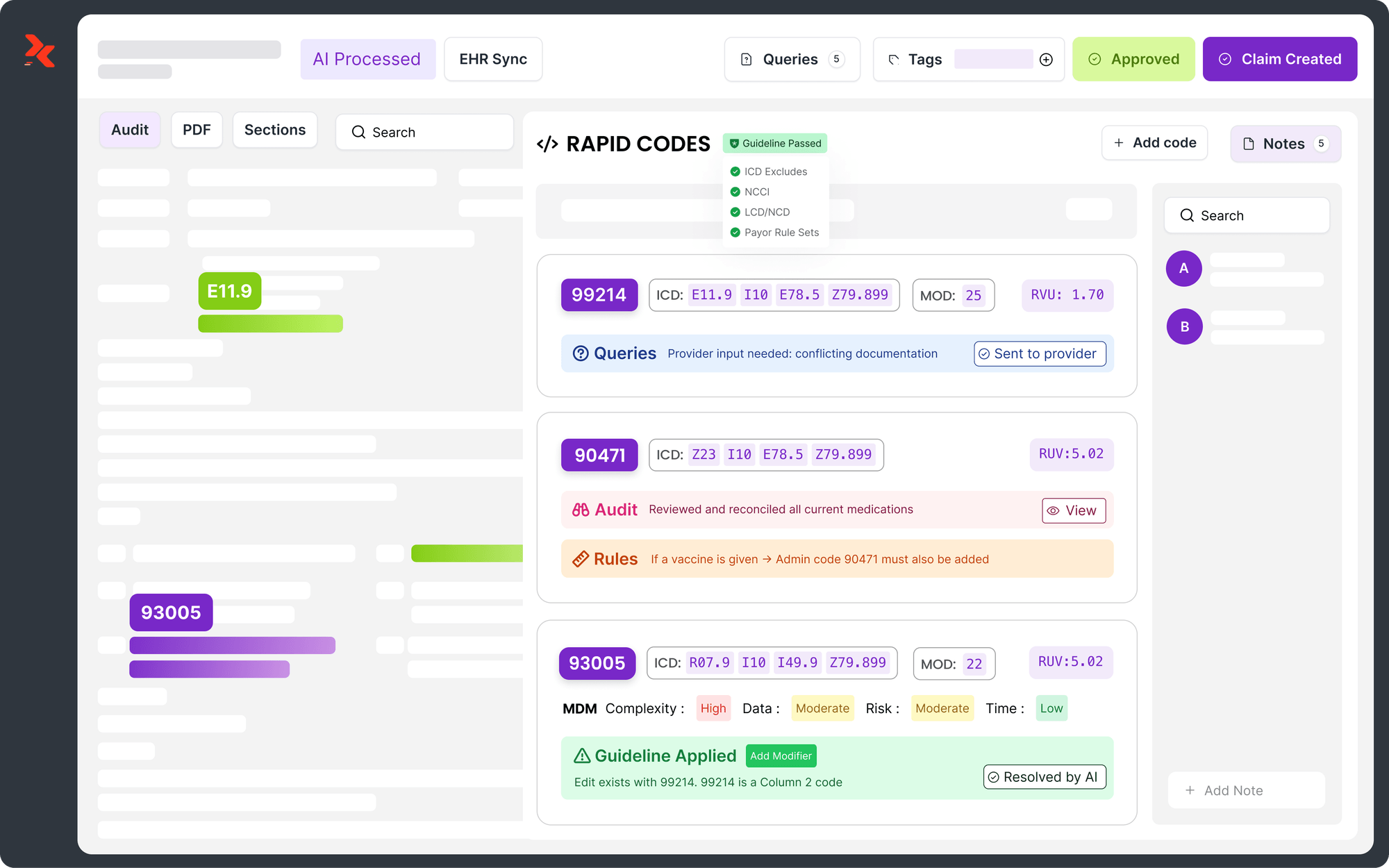

Many FQHCs are now looking at AI supported platforms to address these recurring pain points in coding, documentation, and denials. RapidClaims uses an AI powered revenue cycle engine that has helped organizations reach a 98 percent clean claim rate and cut denials by up to 40 percent, based on internal results. Request a demo to see how similar automation can support your revenue cycle team.

Best Practices for Improving FQHC Revenue Cycle Performance

Improving revenue cycle performance in an FQHC requires coordinated work across front desk staff, clinical teams, coders, and billing specialists. The following practices help strengthen accuracy, reduce delays, and support steady reimbursement.

1. Strengthen Front Desk Intake and Eligibility Verification

Accurate patient information is the foundation of clean claims. Centers benefit from:

- Verifying insurance at every visit

- Confirming income and household details for the sliding fee program

- Ensuring complete demographic data before the encounter reaches coding

This reduces downstream corrections and prevents many avoidable denials.

2. Improve Charge Capture and Coding Accuracy

Charge capture and coding issues often cause delays or lost revenue. FQHC teams can strengthen this step by:

- Using standardized templates in the EHR

- Providing regular training for clinical staff

- Assigning clear workflows for code review and approval

3. Conduct Routine Audits and Compliance Reviews

Regular auditing helps detect patterns early and protects the center from repayment risk. Recommended areas include:

- Documentation completeness

- Encounter qualification under PPS rules

- Coding accuracy for primary and preventive services

4. Reduce Denials Through Pre Submission Review

A structured review process helps identify missing information before claims go out. Many centers benefit from:

- Review of required documentation

- Confirmation of encounter eligibility

- Verification of coding and modifiers

5. Utilize Dashboards and Performance Tracking

A clear view of revenue cycle performance helps leaders identify trends and bottlenecks. Useful metrics include clean claim rate, denial categories, days in accounts receivable, and first pass resolution rate.

For centers that have already standardized intake and coding workflows, the next step is often to automate the most repetitive parts of review and validation. RapidClaims tools such as RapidCode and RapidScrub are designed to support this stage by improving coding accuracy and pre submission edits, with reported coder productivity gains up to 170 percent. Request a demo to explore how these capabilities can be mapped to your current workflows.

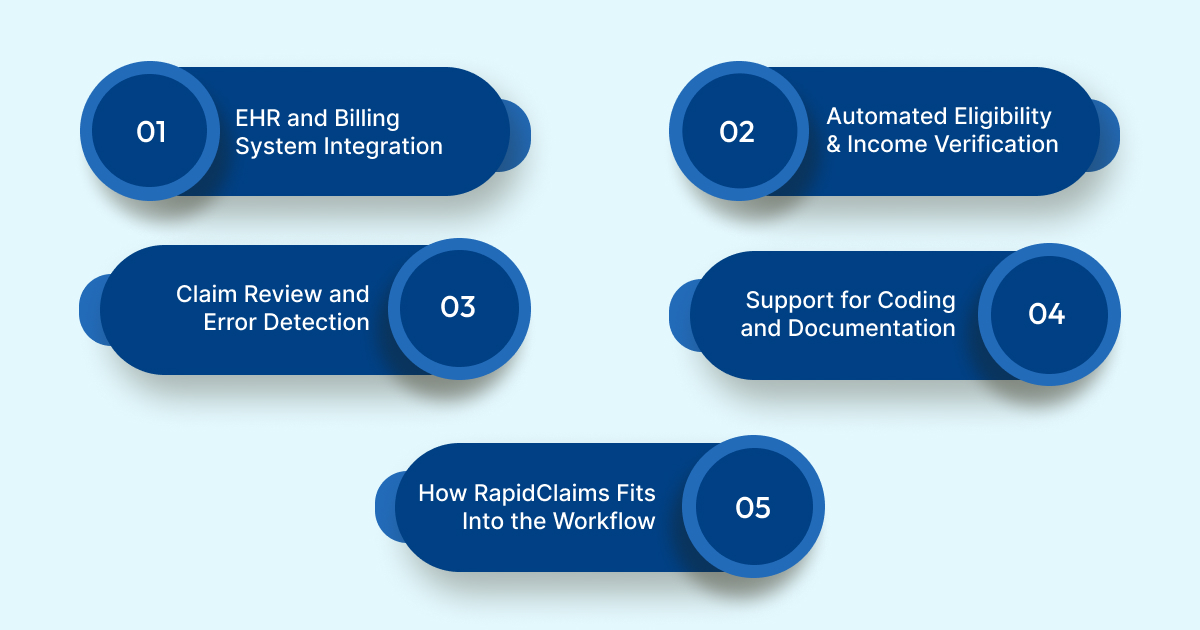

Technology’s Role in FQHC Revenue Cycle Management

FQHC revenue cycle performance improves significantly when centers adopt tools that reduce manual work, increase accuracy, and support consistent documentation. Modern technology helps staff manage large workloads and reduces the impact of staffing shortages.

1. EHR and Billing System Integration

Many centers still work with separate systems that require duplicate data entry. When EHR and billing platforms share information automatically, claims move faster and errors become less common. Integration also reduces the need for staff to reconcile information across multiple systems.

2. Automated Eligibility and Income Verification

Automated verification tools help centers confirm insurance coverage, patient status, and income levels in real time. This supports clean claims and prevents account corrections later in the process.

3. Claim Review and Error Detection

Advanced claim review tools help identify missing documentation or coding issues before submission. This prevents costly denials and reduces the number of claims that require resubmission.

4. Support for Coding and Documentation

AI assisted tools can help coders and clinicians identify the correct codes and ensure that required elements are present in the encounter note. This reduces the burden on staff and supports compliance with PPS rules.

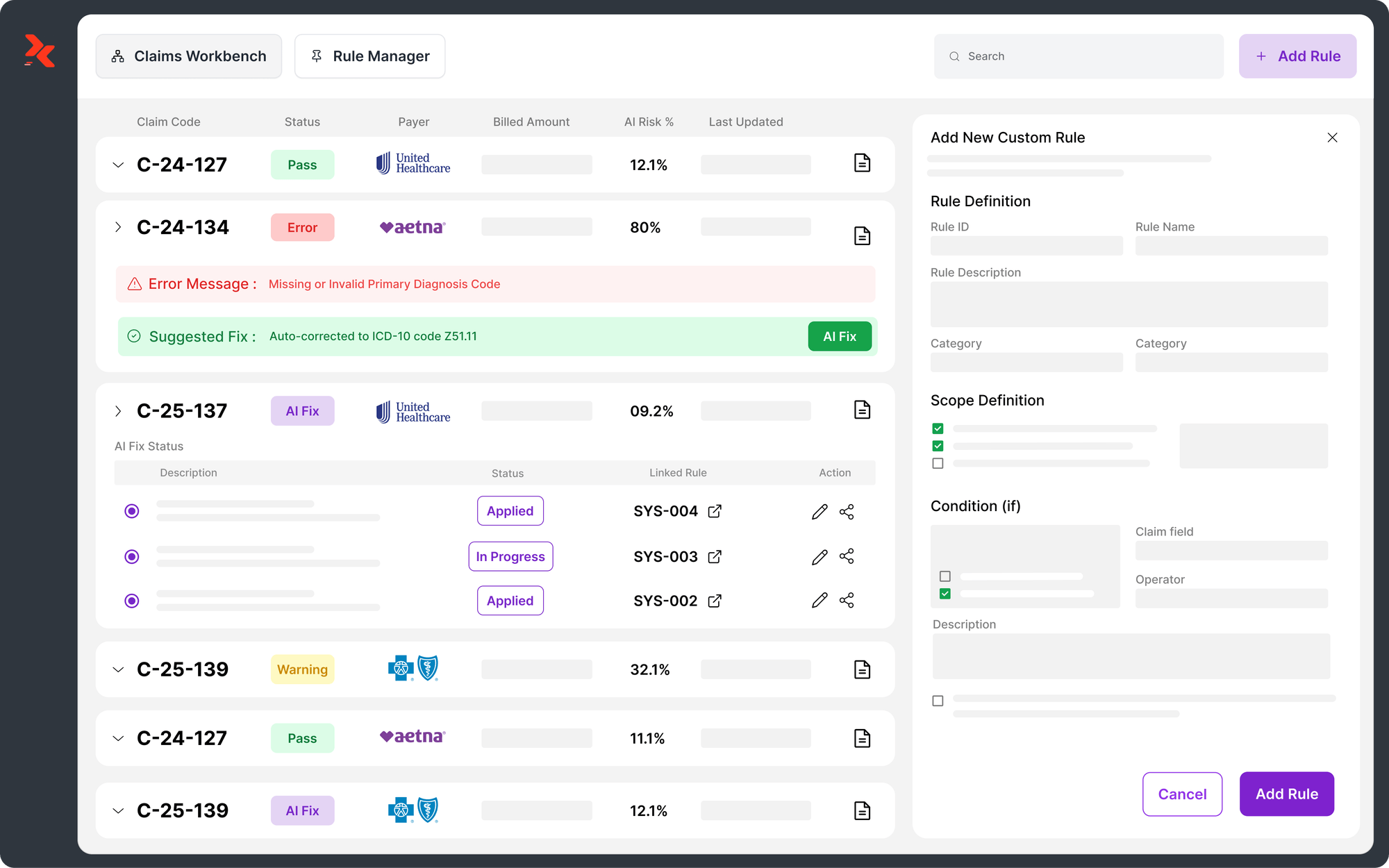

5. How RapidClaims Fits Into the Workflow

RapidClaims provides several tools that address common challenges in FQHC revenue cycle operations. These tools offer examples of how automation can support staff and improve consistency.

- RapidCode supports coding teams by assisting with code selection and documentation review.

- RapidScrub identifies missing or incomplete information that can delay or reduce payment.

- RapidCDI helps improve the accuracy of clinical documentation, especially in high volume settings.

- RapidRecovery supports denial recovery by prioritizing recoverable claims, assisting with appeal workflows, and helping centers recapture revenue that might otherwise be written off.

These technologies help reduce administrative strain and allow teams to focus more time on patient care rather than manual claim correction.

Outsourcing vs In House RCM for FQHCs

Many FQHCs evaluate whether revenue cycle work should remain fully internal or be supported by external billing partners. Each approach offers advantages and limitations, and the right choice depends on staffing capacity, technology infrastructure, and financial goals.

1. When Outsourcing May Be Helpful

Outsourcing can support centers that face chronic staffing shortages or frequent turnover in billing and coding roles. It can also be useful when:

- Claims are frequently delayed or returned

- The internal team lacks experience with complex Medicaid rules

- The center needs help managing a high volume of denials

- The organization is preparing for audits or compliance reviews

External partners can provide additional expertise and help stabilize performance during periods of growth or transition.

2. Benefits of an Experienced FQHC RCM Partner

Specialized partners understand PPS rules, sliding fee requirements, and the unique payer mix that FQHCs manage. This often leads to:

- Faster claim submission

- More consistent follow up

- Stronger accuracy in coding and documentation review

- Reduced administrative pressure on clinical and billing staff

These improvements can help centers maintain steady cash flow and reduce the time spent on corrections or rework.

3. Considerations for Keeping RCM In House

Some FQHCs prefer to maintain full internal control of their revenue cycle. This approach can be effective when:

- The organization has trained billing staff

- The EHR and billing platforms are well integrated

- Leadership wants direct oversight of compliance and workflow management

In house teams often have deeper knowledge of local payer requirements and community needs.

4. What to Look for in an RCM Vendor

FQHCs that consider outsourcing should look for partners with:

- Experience with PPS billing requirements

- Knowledge of Medicaid and Medicare rules

- Clear quality and accuracy processes

- Transparent reporting and performance tracking

- Tools that integrate easily with existing systems

It is also important to ensure that the vendor supports compliance with federal and state requirements.

Suggested read: Healthcare Revenue Cycle Management Software and Services

Key Metrics Every FQHC Should Track

Monitoring the right performance indicators helps FQHCs identify issues early and maintain a healthy revenue cycle. The following metrics give teams a clear view of financial stability and operational efficiency.

1. Clean Claim Rate: The percentage of claims that pass through the system without edits. Higher rates indicate strong documentation and coding accuracy.

2. Denial Rate: Tracks how many claims are rejected by payers. A rising denial rate signals issues with documentation, coding, or eligibility.

3. Days in Accounts Receivable: Shows how long payments take to arrive. Lower values reflect faster processing and better cash flow.

4. First Pass Resolution Rate: Measures the number of claims paid on the first submission. High performance in this area reduces administrative work.

5. Coding Accuracy: Confirms that services are captured correctly. Strong accuracy supports proper PPS payment and compliance.

These metrics help teams understand financial performance and guide decisions that strengthen overall revenue cycle operations.

Opportunities to Improve FQHC RCM in 2026

FQHCs can strengthen financial performance by adopting modern tools, refining workflows, and improving coordination across clinical and billing teams. Several areas offer practical opportunities for improvement.

1. Expand Use of Automation: Automation helps reduce manual tasks, prevent errors, and support faster claim submission. Tools that assist with coding, documentation review, and claim checking can improve accuracy and reduce denials.

2. Enhance Staff Training and Standardization: Consistent workflows across front desk, clinical, and billing staff reduce variation and improve claim quality. Regular training helps teams stay updated on PPS requirements and payer rules.

3. Improve Data Visibility: Dashboards that track key metrics give leaders clearer insight into problem areas. Better visibility supports timely intervention and reduces revenue loss.

4. Strengthen Clinical Documentation: Clear and complete documentation helps coders capture all eligible services. This supports accurate PPS payment and helps prevent audits.

5. Integrate Systems More Effectively: Better connections between EHR and billing platforms reduce errors and limit duplicate work. Integrated systems help ensure that information flows smoothly from intake to claim submission.

FQHCs that want to move from planning to execution often need a partner that can show impact within weeks, not years. RapidClaims supports rapid pilots with few shot deployment models and has reported time to value within the first 30 days in several programs. Request a demo to review a tailored return on investment projection using a sample set of charts from your organization.

Conclusion

FQHCs face increasing pressure to maintain accurate billing, complete documentation, and consistent reimbursement in an environment where patient needs continue to grow. Strong revenue cycle management supports financial stability, protects clinical operations, and ensures that care remains accessible for underserved communities. Centers that focus on workflow consistency, documentation quality, and automation are better prepared for ongoing regulatory, operational, and financial challenges.

Organizations seeking to improve accuracy, reduce denials, or streamline documentation review can explore how RapidClaims supports revenue cycle performance in community health settings. A platform demo provides a clear view of how its tools assist with coding review, documentation checks, and claim readiness.

Request a demo to learn how RapidClaims can help strengthen FQHC revenue cycle operations.

FAQs

Q: What exactly is an FQHC and how is it different from a regular clinic?

A: An FQHC is a community-based health center that receives federal support and provides comprehensive primary and preventive care to underserved populations regardless of ability to pay. FQHCs must meet certain governance, service, and accessibility requirements.

Q: How does revenue cycle management for an FQHC differ from standard medical billing?

A: FQHC RCM is more complex because centers often bill under a per-encounter reimbursement model (like the Prospective Payment System) instead of per-service billing. They also apply sliding fee discounts based on patients’ income and manage a mixed payer population including Medicaid, Medicare, uninsured, and grant-funded services.

Q: What are the main steps involved in FQHC revenue cycle management?

A: Key steps include patient intake and eligibility verification; income verification for sliding fee discounts when applicable; accurate clinical documentation; coding and charge capture; claim submission; follow-up and payment posting; and compliance with federal and state billing regulations.

Q: What are common challenges that lead to revenue loss or denials in FQHCs?

A: Challenges include: managing a complex payer mix; ensuring documentation quality to meet encounter-level billing criteria; handling sliding fee verification; manual coding and charge capture errors; high staff turnover in billing and coding roles; and lack of seamless integration between EHR and billing systems.

Rejones Patta

Rejones Patta is a knowledgeable medical coder with 4 years of experience in E/M Outpatient and ED Facility coding, committed to accurate charge capture, compliance adherence, and improved reimbursement efficiency at RapidClaims.

Latest Post

expert insights with our carefully curated weekly updates

Related Post

Top Products

%201.png)