RAF Scores & Risk Adjustment: How Coding Accuracy Drives Revenue

If you work in healthcare revenue cycle management, medical coding, or provider documentation, you have likely noticed a clear shift in how success is measured. Fee-for-service models that rewarded volume are fading, while value-based care emphasizes outcomes, cost control, and accountability across clinical and financial teams.

At the center of this change sits the Risk Adjustment Factor score, which directly influences reimbursement, forecasting, and regulatory exposure. RAF scores often feel confusing because complex calculations connect documentation quality, diagnosis specificity, and patient risk into a single number.

Whether you code charts or manage revenue projections, inaccurate RAF scores can lead to missed revenue and increased compliance risk. In this guide, we explain what RAF scores mean, how they are calculated, and how better documentation supports accurate, compliant reimbursement.

Key Takeaways:

- RAF scores directly affect reimbursement, benchmarks, and budgets, making accurate documentation and coding financially consequential.

- Chronic conditions must be documented, coded, and submitted every year, or they drop from the risk model.

- Diagnosis specificity and correct hierarchy selection determine whether patient complexity is fully recognized.

- Accepted claims and encounter submissions matter as much as correct coding for RAF recognition.

- Consistent collaboration across providers, coders, CDI, and billing teams supports accurate and compliant RAF capture.

What Are RAF Scores and Medicare Risk Adjustment?

RAF scores are the numeric output of Medicare risk adjustment. They translate a patient’s documented medical complexity into a single value that Medicare uses to adjust payments in risk-based programs, most notably Medicare Advantage.

In simple terms, Medicare risk adjustment is the methodology, and the RAF score is the result. The process ensures that providers and health plans are paid more for caring for sicker, more complex patients and less for healthier ones, based on documented clinical evidence.

Understanding RAF scores requires understanding how the three components work together:

- Medicare risk adjustment (the payment framework)

- HCC coding (how diagnoses are grouped and weighted)

- RAF scoring (how those weights become a payment multiplier)

Understanding this relationship is essential for accurate reimbursement, reliable forecasting, and compliance under risk-based payment models.

Why Medicare Adjusts Payments Based on RAF Scores

Without risk adjustment, organizations treating complex patient populations would be systematically underfunded. Medicare uses RAF scores to align payments with expected care needs rather than visit volume alone.

Under Medicare Advantage and related programs, RAF-based risk adjustment is used to:

- Increase payments for patients with higher expected medical costs

- Reduce incentives to avoid enrolling medically complex patients

- Establish fair spending benchmarks across risk-based contracts

Centers for Medicare & Medicaid Services relies on RAF scores calculated from documented and submitted diagnoses. If conditions are not captured accurately during the year, the patient’s true complexity is not reflected in payment.

Also Read: Understanding HCC Coding and Risk Adjustment

How Risk Adjustment and HCC Coding Drive RAF Scores

Risk adjustment operationalizes documented patient complexity through RAF scores calculated from demographic data, diagnosis coding mapped to HCCs, and CMS model rules. Accuracy depends on correct execution at each stage; failures in documentation, coding, or submission reduce recognized patient risk.

To understand where accuracy is gained or lost, here is the process broken into five distinct steps:

Step 1: Diagnosis Coding Feeds the Risk Model

RAF scoring begins with ICD-10-CM diagnosis codes submitted on claims or encounters. CMS maps eligible diagnoses to Hierarchical Condition Categories that represent chronic or high-cost conditions expected to affect future utilization.

Acute or temporary diagnoses do not map to HCCs, while chronic conditions such as COPD, heart failure, or diabetes with complications typically do. CMS updates mapping tables with each model year, making version awareness essential for coding teams.

Step 2: Hierarchies Prevent Duplicate Risk Credit

HCCs follow hierarchy rules designed to prevent duplicate risk credit for related conditions. When multiple diagnoses fall within the same disease group, only the most severe category contributes to the RAF score.

For example, diabetes with complications supersedes diabetes without complications when documentation supports both. Specificity improves risk capture, while unsupported severity increases audit exposure without improving legitimate reimbursement.

Step 3: The RAF Score Is Calculated Additively

The RAF score is calculated by combining a base demographic factor with all applicable HCC risk weights and any valid interaction factors. Demographics include age, sex, disability status, and Medicaid dual eligibility, each contributing a defined value.

In simplified terms:

RAF score = demographic factor + HCC weights + interaction factors

Even modest changes in documented conditions can materially change the final score, reinforcing the need for consistent capture of all active chronic conditions.

Step 4: Annual Reset Requires Ongoing Recapture

RAF scores reset every calendar year, and chronic conditions do not carry forward automatically. Each active diagnosis must be documented, coded, and submitted again during the current year to remain counted.

Missed recaptures commonly occur during routine visits, outdated problem lists, or incomplete wellness encounters, causing HCCs to drop and lowering projected reimbursement.

Step 5: Submission Determines Whether Coding Counts

CMS calculates RAF scores using accepted claims and encounter data, including EDPS submissions. Correct coding does not count if claims are rejected, incomplete, or never transmitted successfully.

This makes coordination across documentation, coding, and billing essential, since breakdowns at any point prevent patient risk from being recognized.

After reviewing the workflow components, it helps to see how those pieces come together inside the actual scoring formula.

Also Read: Utilizing Data for Value-Based Care Improvement

Breaking Down RAF Score Calculations

Once diagnoses, hierarchies, and submission rules are applied, CMS converts patient data into a single numeric RAF score. This score represents the relative expected cost compared to an average Medicare beneficiary.

Each patient starts with a base demographic value assigned by CMS. That value reflects age, sex, and eligibility status already established in the risk model. CMS then adds predefined risk weights for every valid HCC captured during the year. These weights are published annually and remain fixed for the model year.

Certain condition combinations trigger interaction factors, which add incremental value when documented conditions are known to increase costs together. These interactions are limited and tightly defined by CMS.

The calculation itself is straightforward:

RAF score = base demographic value + total HCC weights + applicable interaction factors

What matters operationally is how individual data points change the final number.

Interpreting the RAF Score

Once calculated, the RAF score is interpreted relative to the Medicare average:

- A RAF score of 1.00 represents the expected cost of an average Medicare beneficiary

- Scores above 1.00 indicate higher-than-average medical complexity and higher expected reimbursement

- Industry estimates suggest that a one percent increase in RAF may add approximately $150 to $200 per member annually, depending on plan rates

Even small changes in documented conditions can materially affect projected revenue across large patient populations.

Example calculation using illustrative values:

*Note: Weights shown for demonstration only.

In this scenario, each documented condition contributes directly to the total RAF score. The combined result reflects slightly higher expected costs than the Medicare average.

If one qualifying condition is not captured during the year, its weight is removed from the calculation. The score decreases even though the patient’s clinical status remains the same.

The next step is understanding how these calculated scores directly influence payment models and contract performance.

Also Read: AI Role in Successful Revenue Cycle Management

The Financial Impact of RAF Accuracy in Medicare Advantage

RAF scores directly influence how much funding your organization receives to care for patients with varying levels of medical complexity. When RAF values do not reflect true patient acuity, reimbursement models assign budgets that fail to match actual care needs.

This impact shows up differently across payment models, but the financial consequences remain consistent.

- Medicare Advantage payments: Plan reimbursement is calculated by multiplying a base rate by each enrollee’s RAF score, meaning lower RAF values reduce available care funding.

- Shared savings benchmarks: CMS sets cost targets in ACO and MSSP programs using risk-adjusted benchmarks, so underreported RAF lowers targets and increases financial downside risk.

- Capitated payment models: Medicaid managed care and capitated primary care contracts use RAF-style multipliers, where incomplete risk capture leads to insufficient per-member budgets.

- Population health resourcing: Accurate RAF scores support fair funding for high-need patients, allowing investment in care management, pharmacy support, and chronic condition oversight.

- Quality performance alignment: When chronic conditions are properly coded, care teams can track, manage, and report against related quality measures more consistently.

When reimbursement depends on RAF accuracy, even minor documentation issues can create outsized financial consequences.

Also Read: Claim Denials: Common Reasons and How to Effectively Resolve Them

Documentation and Coding Challenges That Lower RAF Scores

Even when teams understand risk adjustment rules, day-to-day documentation and coding gaps often prevent accurate RAF capture. These issues usually stem from workflow habits, documentation patterns, and submission breakdowns rather than intent.

Here are some recurring challenges that consistently reduce reported patient risk:

- Incomplete clinical support: Chronic conditions must meet MEAT standards, meaning notes must show monitoring, evaluation, assessment, or treatment during the encounter.

- Annual recapture gaps: Chronic diagnoses must be documented and coded every calendar year, or the CMS model assumes the condition has resolved.

- Non-specific diagnosis selection: Unspecified ICD-10 codes often map to lower or no HCC value compared to more detailed, clinically supported codes.

- Hierarchy misapplication: Coding a lower-severity condition when documentation supports a higher one undercounts risk because only the highest HCC is recognized.

- “History of” wording: Using history codes for active conditions removes HCC credit, even when the patient continues treatment or clinical monitoring.

- Submission and acceptance failures: Valid diagnoses do not count when claims or encounter files are rejected due to formatting or missing data elements.

- Missed supplemental data: Valid conditions captured during wellness visits or assessments may be excluded if not submitted through approved CMS pathways.

- Unsupported HCC reporting: Diagnoses without sufficient chart evidence risk removal during audits, which lowers RAF scores retroactively.

Recognizing these pitfalls creates an opportunity to adjust workflows before revenue and compliance issues escalate.

RAF Accuracy: Best Practices and Proven Strategies

Improving RAF accuracy depends on consistent documentation habits, disciplined coding workflows, and proactive oversight across clinical, coding, and billing teams. Small process improvements compound quickly when applied across high-risk patient populations and recurring encounters.

The following practices focus on accuracy, defensibility, and repeatability:

- MEAT-supported documentation: Ensure every chronic condition shows monitoring, evaluation, assessment, or treatment within the note, even when the condition remains stable.

- Annual condition recapture: Use yearly wellness and chronic care visits to restate all persistent diagnoses, since prior-year documentation does not carry forward automatically.

- Pre-visit planning: Review last year’s coded conditions before appointments so providers can address unresolved diagnoses during the encounter.

- Concurrent CDI review: Perform documentation review before claim submission to clarify missing details, such as disease stages or complication status.

- Provider-focused education: Teach clinicians to document condition status and management rather than coding rules, which naturally supports compliant risk capture.

- Problem list maintenance: Keep problem lists current so active diagnoses remain visible to providers, coders, and care teams during each visit.

- Formal query processes: Use compliant queries when documentation lacks clarity, allowing coders to assign the most accurate diagnosis supported by the record.

- Regular chart audits: Review samples of coded encounters to identify missed HCCs, unsupported diagnoses, and recurring documentation gaps.

- Data trend monitoring: Track RAF movement, rejection rates, and condition drop-offs to identify issues early rather than after reconciliation cycles.

- Technology-assisted review: Apply advanced tools that flag undocumented chronic conditions or missing specificity while preserving coder and provider judgment.

Applying best practices consistently often requires tools that reinforce documentation and coding expectations in real time.

Also Read: A Comprehensive Guide on Medical Coding: Here is What You Need to Know

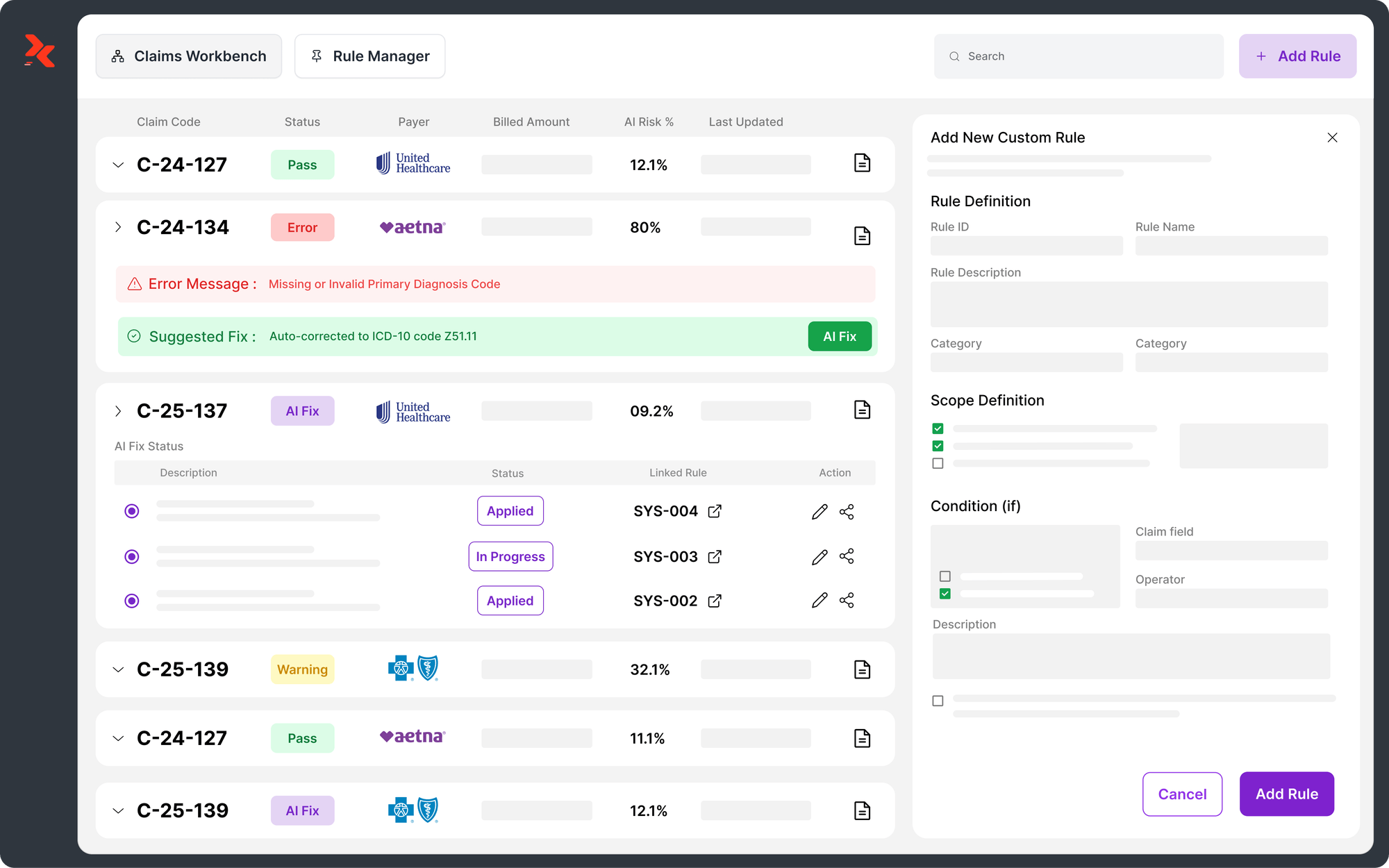

How RapidClaims Helps Organizations Sustain Accurate RAF Scores

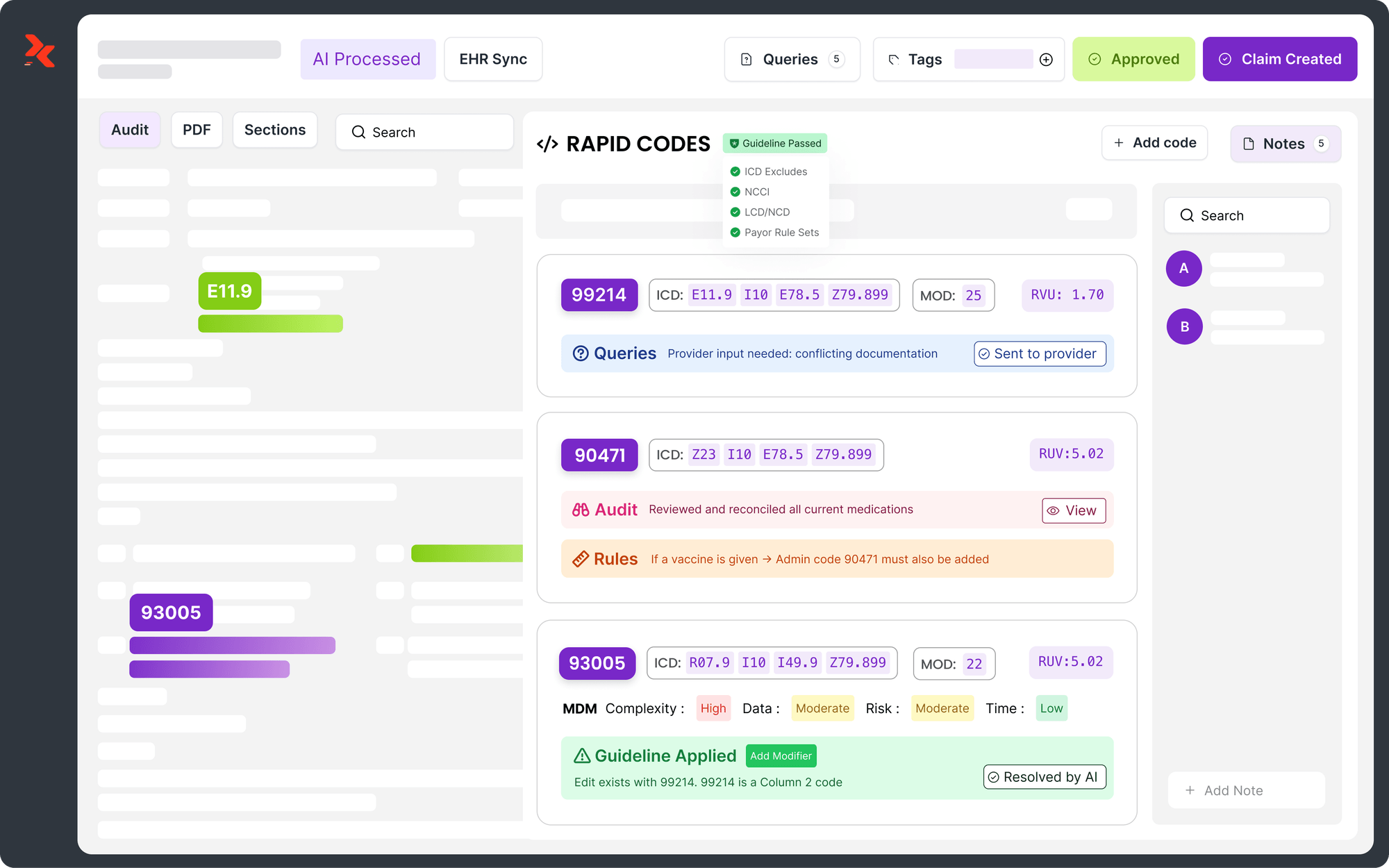

Accurate RAF scoring depends on consistent execution across documentation, coding, and submission workflows rather than isolated fixes or retrospective corrections. RapidClaims Risk Adjustment Software built for accurate HCC & RAF Scoring supports this discipline by embedding intelligence directly into everyday revenue cycle activities.

Here are the operational outcomes supported by this approach:

- RapidCode: AI-powered medical coding reviews clinical documentation to identify supported diagnoses and prevent denials tied to missed or misclassified HCCs.

- RapidScrub: AI-powered denial prevention and recovery checks claims for submission errors and unsupported risk factors before payer review occurs.

- RapidCDI: Tools that transform data into revenue intelligence help teams see documentation gaps, RAF impact, and risk trends across patient populations.

Together, these components support accurate risk capture by addressing documentation, coding, and submission risks across the whole revenue cycle.

Conclusion

Accurate RAF scores depend on consistent documentation, precise coding, and successful claim submission across every encounter and calendar year. When any part of that chain breaks, reimbursement falls, and compliance risk increases across value-based and capitated contracts.

RapidClaims helps coding, CDI, and billing teams protect documented patient risk from the chart through final submission. If you want to see how this approach fits into your current workflows, book a demo with us to review use cases relevant to your organization.

FAQs

1. Do RAF scores affect commercial or employer-sponsored plans?

RAF scores primarily apply to Medicare Advantage, Medicaid managed care, and ACA marketplace plans. Commercial employer-sponsored plans typically do not use CMS RAF models, although some adopt internal risk-adjustment methods inspired by them.

2. Can RAF scores change mid-year if documentation improves later?

Yes, RAF scores can change during the year as long as qualifying diagnoses are documented, coded, and successfully submitted before CMS data submission deadlines. Late documentation after cutoffs will not retroactively adjust payment.

3. How do audits affect previously reported RAF scores?

If an audit removes unsupported HCCs, CMS recalculates RAF scores retroactively. This can result in payment recoupments, making documentation support and audit readiness as important as initial risk capture.

4. Do specialist visits contribute to RAF scoring, or only primary care encounters?

Specialist encounters can contribute to RAF scoring if diagnoses meet CMS requirements and are submitted correctly. The key factor is valid documentation and accepted encounter data, not provider specialty.

5. What happens when a patient changes Medicare Advantage plans mid-year?

RAF data follows the patient, not the plan. Diagnoses documented earlier in the year can still count toward risk adjustment for the new plan, assuming data submission requirements are met.

Rejones Patta

Rejones Patta is a knowledgeable medical coder with 4 years of experience in E/M Outpatient and ED Facility coding, committed to accurate charge capture, compliance adherence, and improved reimbursement efficiency at RapidClaims.

Latest Post

expert insights with our carefully curated weekly updates

Related Post

Top Products

%201.png)

.jpg)