.webp)

Telehealth Place of Service Code: A Complete Guide

Telehealth has rapidly transformed the way healthcare is delivered in the United States. From remote patient consultations to virtual therapy sessions, healthcare providers are increasingly utilizing telemedicine to expand access, reduce costs, and enhance patient outcomes.

According to the 2024 National Telehealth Survey, 54% of Americans have now had a telehealth visit, and satisfaction among telehealth users remains high, with 89% reporting satisfaction with their most recent visit. However, understanding how to code and bill telehealth services accurately is crucial for ensuring proper reimbursement and compliance with regulations. One of the most essential elements in this process is the Telehealth Place of Service (POS) code.

In this blog, you will explore essential telehealth place of service codes, understand coding guidelines, and see examples to ensure accurate documentation and correct reimbursement.

TL;DR (Key Takeaways)

- Telehealth place of service codes, such as POS 02, 10, 11, 12, and 21–33 specify the care setting for accurate billing and reimbursement.

- Using the correct telehealth modifiers 95, 93, GQ, GT, and FQ ensures proper claim processing and prevents denials.

- Complete documentation of patient consent, technology used, provider and patient location, and services delivered is required for compliance.

- Pairing POS codes with CPT codes in real-world scenarios improves billing accuracy and revenue cycle efficiency.

- Implementing best practices and tools, such as RapidClaims, reduces errors, automates coding, and streamlines telehealth billing workflows.

Table of Contents:

- What Is a Telehealth Place of Service (POS) Code?

- Telehealth Place of Service Codes and Their Applications

- What are the Telehealth Modifiers and their Uses?

- Comprehensive Documentation Tips for Telehealth Compliance

- Real-World Examples of Telehealth POS Coding

- Common Pitfalls in Telehealth Place of Service Coding

- Best Practices for Accurate Telehealth POS Coding

- Conclusion

- Frequently Asked Questions (FAQs)

What Is a Telehealth Place of Service (POS) Code?

A Place of Service (POS) code is a two-digit numeric code used on professional claims to indicate the location where healthcare services were provided. For telehealth, POS codes inform payers that the service was delivered remotely, rather than in a traditional office or facility. Proper POS coding ensures compliance with payer policies, prevents claim denials, and streamlines reimbursement.

Now, let’s examine the specific telehealth place of service codes and their applications, so you know exactly when and how to use each code.

Telehealth Place of Service Codes and Their Applications

The CMS maintains a standardized set of Place of Service (POS) codes used to indicate the setting in which healthcare services are provided. For telehealth services, the appropriate POS code ensures accurate billing, compliance, and reimbursement

1. POS 02 – Telehealth Provided Other than Patient’s Home

This code is used when a patient receives telehealth services at a location other than their home, such as a clinic, nursing facility, or hospital outpatient department. It distinguishes facility-based telehealth visits from home-based care.

- Billing Implications: Medicare reimburses these visits at facility rates, and commercial payers generally follow similar policies. Correct use ensures proper reimbursement, compliance, and audit readiness.

- Example: A physician conducts a virtual follow-up with a patient in a nursing home to review lab results, adjust medications, and provide care instructions, all without an in-person visit.

2. POS 10 – Telehealth Provided in Patient’s Home

Use this code when a patient participates in a telehealth visit from their personal residence. This reflects patient-centered care delivered directly to the home.

- Billing Implications: Medicare reimburses these services at non-facility rates, and commercial payers typically follow similar guidelines for home-based telehealth services. Accurate use ensures proper reimbursement and compliance with telehealth regulations.

- Example: A patient with hypertension receives a video consultation from the comfort of their own home. The provider reviews medications, discusses lifestyle counseling, and adjusts the care plan without requiring an office visit.

3. POS 11 – Office

This code is used for telehealth services originating from the provider’s office, typically for billing to commercial payers. Telehealth encounters should include modifiers 95 (synchronous telemedicine) or GT (interactive telecommunication) to indicate the virtual nature of the visit.

- Billing Implications: Correct use ensures compliance with payer rules for office-based telehealth, avoids claim denials, and supports accurate reimbursement.

- Example: A behavioral health provider conducts a therapy session from their office using a secure video platform. The provider documents the session, including patient engagement and clinical notes, without the patient physically present in the office.

4. POS 12 – Home

This code is used for telehealth services provided under specific payer programs that deliver home-based care. It is distinct from POS 10 in certain Medicare Advantage or commercial plan guidelines.

- Billing Implications: Using POS 12 correctly ensures claims comply with plan-specific reimbursement rules and avoid denials for home-based telehealth services.

- Example: A patient with diabetes participates in remote patient monitoring from the comfort of their own home. The provider reviews glucose logs, adjusts medications, and provides care guidance under a structured home care program.

5. POS 21 – Inpatient Hospital

Use this code when a patient admitted to a hospital receives telehealth consultations from a provider who is located off-site. This ensures the encounter is recognized as inpatient care delivered remotely.

- Billing Implications: Correct usage ensures proper reimbursement for inpatient facility-based services and clearly distinguishes telehealth services from in-person hospital care.

- Example: A tele-neurology consult is conducted for a stroke patient admitted to the hospital. The specialist reviews imaging, monitors progress, and provides recommendations from an off-site location.

6. POS 22 – On-Campus Outpatient Hospital

Use this code when telehealth services are delivered to patients located in hospital outpatient departments. It ensures that virtual visits are correctly classified as outpatient facility-based care.

- Billing Implications: Accurate use distinguishes outpatient telehealth from other facility-based services, ensuring proper reimbursement and compliance with CMS and commercial payer policies.

- Example: A patient visiting a hospital outpatient clinic receives a tele-dermatology evaluation. The provider reviews the patient’s skin condition, recommends treatment, and documents the encounter without requiring an in-person consultation.

7. POS 24 – Ambulatory Surgical Center (ASC)

Use this code when a patient receives telehealth services related to care in an Ambulatory Surgical Center. This includes pre-operative or post-operative virtual consultations.

- Billing Implications: Proper use ensures accurate outpatient surgical facility billing and compliance with CMS and commercial payer guidelines.

- Example: A patient undergoes a minor outpatient procedure in an ASC and participates in a telehealth follow-up to review recovery progress and wound care instructions.

8. POS 31 – Skilled Nursing Facility

Use this code when telehealth services are delivered to patients residing in a skilled nursing facility. This includes virtual consultations, remote monitoring, or follow-up visits for ongoing care.

- Billing Implications: Correctly using POS 31 ensures proper facility-based reimbursement, aligns with CMS telehealth policies, and differentiates SNF-based telehealth from office or home visits.

- Example: A cardiologist conducts a video follow-up for a patient recovering from a heart procedure in a skilled nursing facility. The physician reviews vital signs, medications, and care plans without requiring an in-person visit.

9. POS 32 – Nursing Facility

Used when a patient receives telehealth services while admitted to a nursing facility, including chronic care management or specialty consultations.

- Billing Implications: Correct coding ensures services are reimbursed at nursing facility rates and distinguishes facility-based telehealth from home or office visits.

- Example: A geriatric specialist conducts a telehealth visit to review a patient’s medication regimen and monitor vital signs in a nursing facility setting.

10. POS 33 – Custodial Care Facility

Applies to telehealth services delivered to patients in custodial care settings, focusing on ongoing non-acute support and care planning.

- Billing Implications: Using POS 33 ensures compliance with payer rules and proper classification for custodial care services delivered virtually.

- Example: A care coordinator conducts a telehealth session for a patient in a custodial care facility to review daily care needs, monitor symptoms, and adjust care plans.

These POS codes, when used correctly in combination with telehealth-specific modifiers (95, GT, GQ, G0) and thorough documentation, prevent claim denials, support compliance, and optimize revenue cycle management.

For a comprehensive list of all POS codes and their official descriptions, refer to the CMS Place of Service Code Set.

Proper use of POS codes, accurate modifiers, and thorough documentation are crucial for compliance and reimbursement; however, managing these tasks manually can be complex and time-consuming. Platforms like RapidClaims simplify this process, ensuring coding accuracy, streamlining claim submissions, and supporting a more efficient revenue cycle.

Now that you understand telehealth POS codes, it’s crucial to learn how to apply them correctly, along with the appropriate modifiers and documentation, to ensure accurate reimbursement.

What are the Telehealth Modifiers and their Uses?

In medical billing, modifiers are used to clarify how a telehealth service was delivered. Different modifiers apply based on whether the service was conducted through video, audio, or asynchronous methods. These modifiers help payers understand the communication mode, ensuring proper reimbursement and compliance with regulations.

1. Modifier 95: Indicates synchronous telemedicine provided through real-time audio and video communication between provider and patient.

2. Modifier 93: Used when telemedicine is delivered synchronously through audio-only technology, such as telephone consultations.

3. Modifier GQ: Applied when telehealth is conducted via asynchronous (store-and-forward) communication systems, where information is reviewed at a later time.

4. Modifier GT: Represents synchronous telehealth services provided through interactive audio and video platforms. Though Medicare no longer requires GT for professional claims, many private insurers still recognize it.

5. Modifier FQ: Specifies that the telehealth service was furnished through audio-only real-time communication technology.

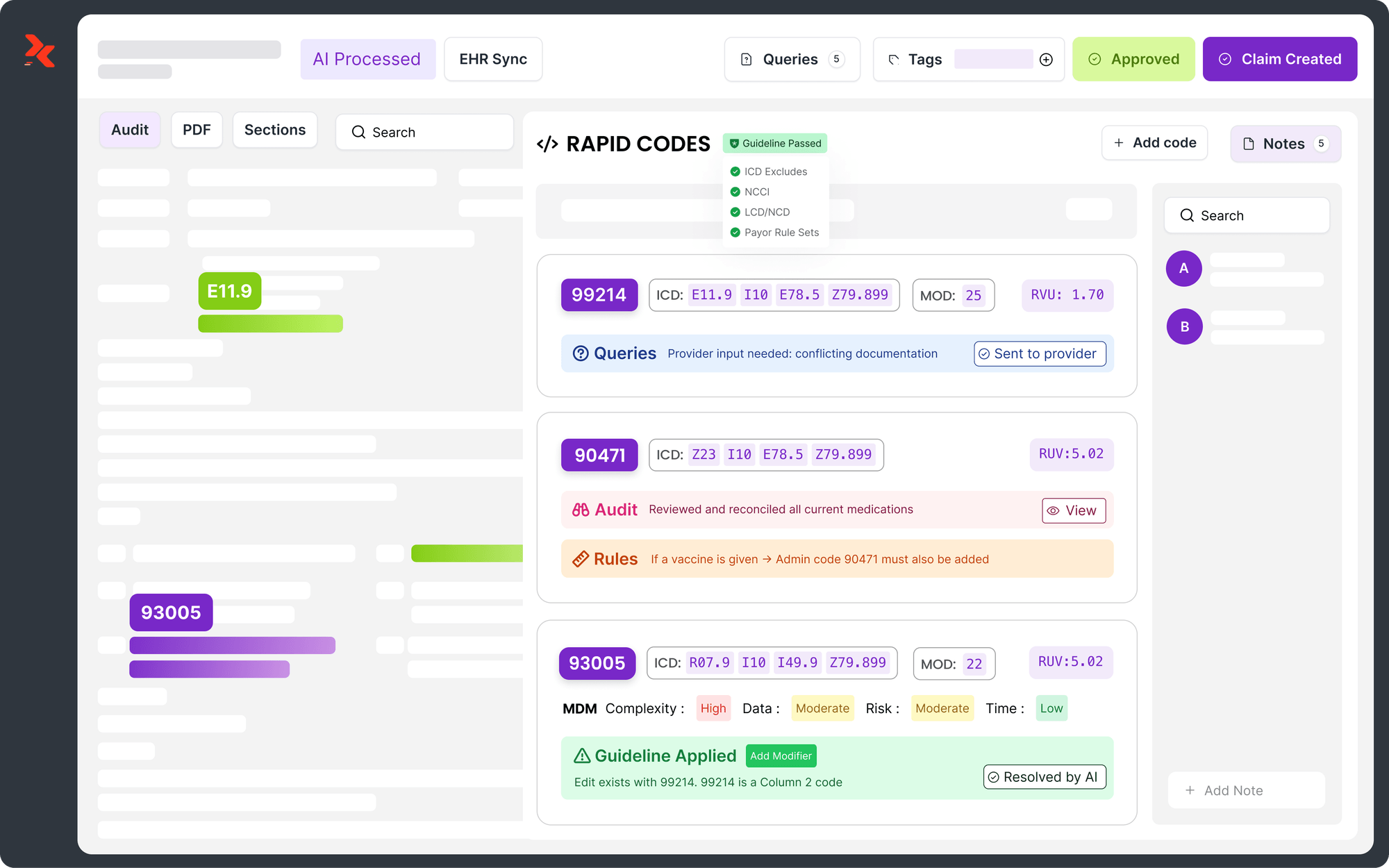

To further enhance the coding experience, RapidClaims integrates powerful cross-referencing features that link HCPCS, ICD-10, and CPT codes. This connection improves coding accuracy, reduces claim denials, and streamlines the reimbursement process.

Comprehensive Documentation Tips for Telehealth Compliance

Accurate documentation in telehealth is not just about clinical accuracy but also about meeting regulatory, billing, and legal requirements. Providers must ensure that every encounter reflects informed consent, proper use of technology, patient-provider location, and service details to remain compliant with federal and state guidelines.

- Record Patient Consent for Telehealth Services

Consent is a legal requirement in telehealth. Providers should document whether the patient gave verbal or written consent, along with the date and method of capture. This ensures transparency and protects against liability in case of disputes.

- Document the Platform Used

The technology platform (video, phone, secure messaging, or EMR-integrated systems) must be recorded. This not only supports compliance with HIPAA standards but also verifies the appropriateness of the medium for the medical service delivered.

- Include the Location of Both Provider and Patient

Telehealth billing and legal compliance often require specifying the provider’s site of practice and the patient’s location at the time of service. Capturing this detail ensures accurate jurisdictional reporting and reimbursement eligibility.

- Clearly Describe Services Rendered

Every telehealth encounter should detail the medical service provided, including telehealth-specific factors such as limitations due to remote assessment. This strengthens clinical accuracy, supports medical necessity, and ensures clean claim submission.

Accurate use of modifiers combined with the correct POS code prevents claim denials, supports audit defense, and ensures proper reimbursement.

With the modifiers and documentation covered, let’s explore real-world examples of telehealth POS coding, which will help solidify understanding and provide practical guidance for your revenue cycle operations.

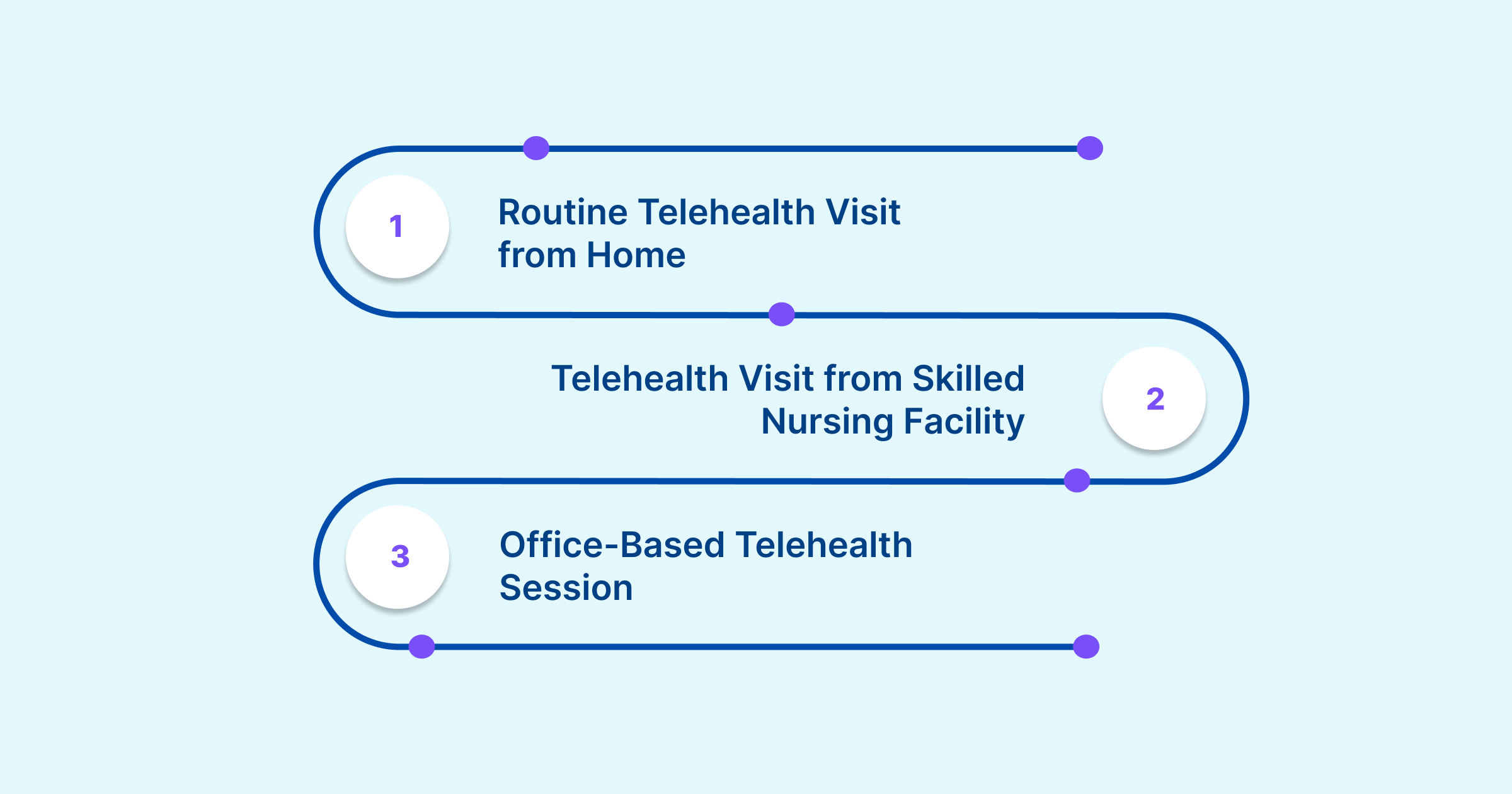

Real-World Examples of Telehealth POS Coding

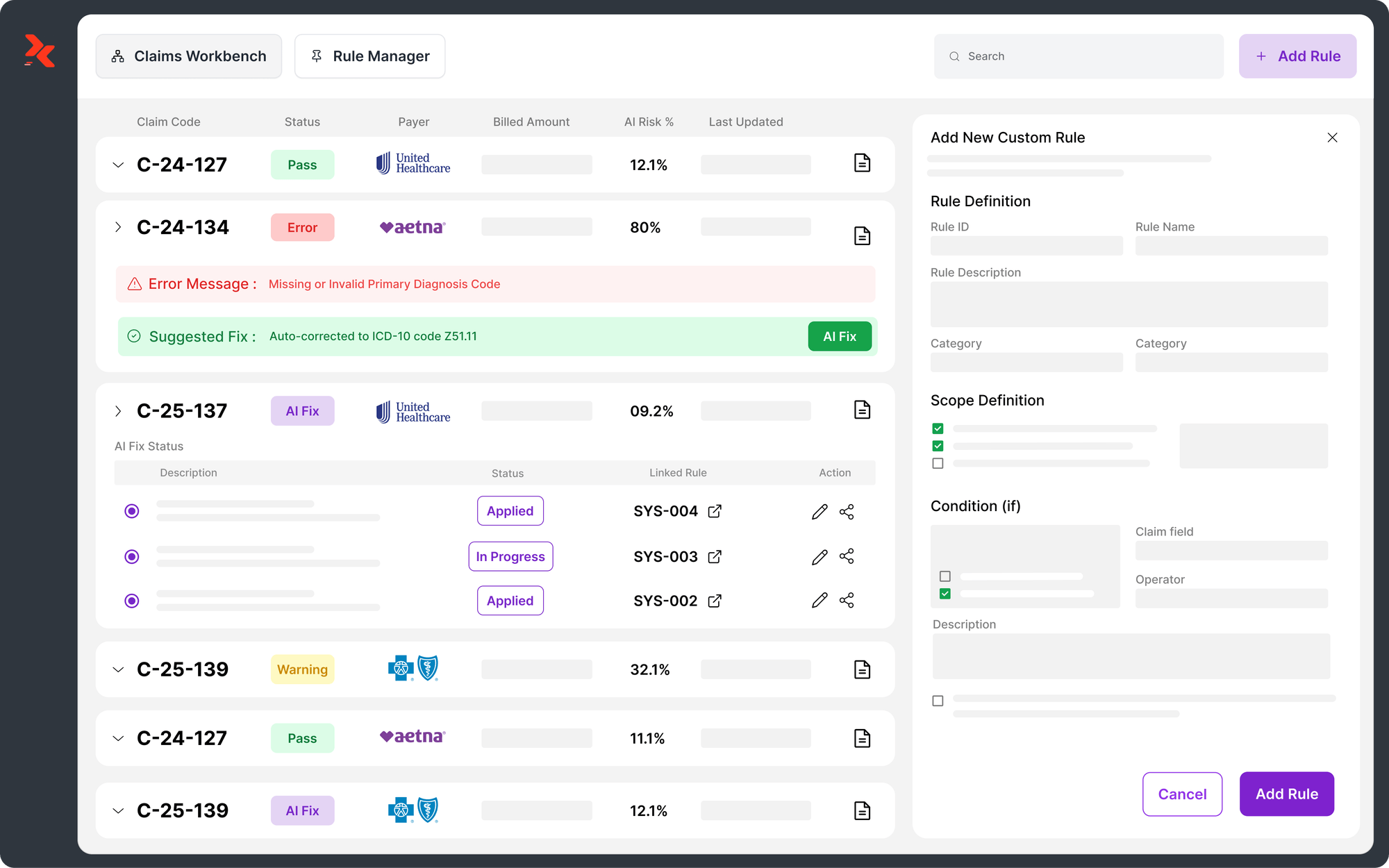

The following examples demonstrate how telehealth place of service codes, when combined with CPT codes and modifiers, accurately capture the specific care setting. Correct coding in these cases reduces claim denials, maintains compliance, and ensures providers receive accurate reimbursement.

Example 1: Routine Telehealth Visit from Home

- POS Code: 10

- CPT Code: 99213

- Modifier: 95

- Scenario: A patient attends a follow-up appointment for hypertension management via secure video conferencing from home. The provider reviews medications, checks blood pressure logs, and adjusts therapy without requiring an in-person visit.

Example 2: Telehealth Visit from Skilled Nursing Facility

- POS Code: 02

- CPT Code: 99214

- Modifier: 95

- Scenario: A patient in a skilled nursing facility receives a virtual check-in with their physician to manage diabetes and review lab results. The telehealth visit allows timely care while avoiding unnecessary transfers.

Example 3: Office-Based Telehealth Session

- POS Code: 11

- CPT Code: 90834 (Therapy Session)

- Modifier: 95

- Scenario: A behavioral health provider conducts a psychotherapy session via video from their office. The encounter is billed under the office POS to reflect the provider’s originating site.

These real-world cases demonstrate how the optimal combination of POS codes, CPT codes, and modifiers yields a comprehensive billing picture.

Common Pitfalls in Telehealth Place of Service Coding

Even skilled providers and coders can face challenges when assigning telehealth place of service codes. Errors in this process can lead to delayed reimbursement, compliance risks, and unnecessary administrative burdens. The most frequent pitfalls include:

- Incorrect POS selection: For example, reporting POS 11 (office) instead of POS 10 (home) when a patient connects from their residence, resulting in misaligned reimbursement.

- Omission or misuse of modifiers: Failing to attach required modifiers such as 95 or 93 often triggers claim denials.

- Incomplete documentation: Not recording the patient’s location, provider’s location, or telehealth consent can create compliance gaps.

- Code confusion: Submitting in-person CPT codes without the proper telehealth modifier can lead to misclassification, audits, and denials.

After reviewing these common pitfalls, implementing structured strategies is essential to ensure accurate coding, compliance, and optimized reimbursement.

Best Practices for Accurate Telehealth POS Coding

Avoiding coding errors requires organizational consistency and a proactive approach to development. Establishing clear standards, training staff, and auditing claims are key to accurate telehealth billing. Best practices include:

- Monitor payer updates: Stay informed on CMS guidance and commercial payer rule changes, as telehealth policies continue to evolve.

- Standardize workflows: Implement organization-wide coding protocols to maintain consistency across providers and billing teams.

- Invest in training: Educate coders and clinicians regularly on the use of modifiers, POS coding rules, and documentation requirements.

- Audit proactively: Conduct routine reviews of telehealth claims to identify errors early and protect revenue.

By avoiding pitfalls and following these best practices, telehealth POS coding becomes more than a compliance task; it supports financial stability and improves patient care outcomes.

Conclusion

Telehealth Place of Service Codes are vital for accurate billing, compliance, and smooth revenue cycle management. Correctly applying POS 02, POS 10, and other facility-based codes, along with proper modifiers and documentation, reduces claim denials and audit risks while supporting high-quality virtual care.

RapidClaims streamlines this process with real-time code validation, EHR integration, and predictive search. Tools like RapidCode, RapidScrub, and RapidCDI automate documentation, improve coding accuracy, and strengthen revenue cycle efficiency.

Take control of your telehealth coding today. Request a Free Demo of RapidClaims to simplify medical coding, optimize billing, and ensure compliance.

Frequently Asked Questions (FAQs)

1. Can I use telehealth modifiers for in-person visits?

A. No, telehealth modifiers like 95, 93, GQ, GT, and FQ are designed explicitly for virtual encounters. Using them for in-person visits can lead to claim denials. Always ensure that the modifier matches the actual mode of service delivery.

2. Are there any restrictions on using telehealth modifiers for behavioral health services?

A. Yes, some payers have specific guidelines for behavioral health services. For instance, UnitedHealthcare accepts modifiers 93, 95, or FQ for such services. It's essential to verify with each payer to ensure compliance.

3. Do I need to use a modifier for every telehealth service?

A. Not necessarily. Some services, such as those listed in the CPT manual's Appendix P (audio-video) or T (audio-only), may not require additional modifiers if the code description already indicates that the service is telehealth. Always refer to the specific code guidelines for details.

4. Can I bill for telehealth services provided to patients outside the U.S.?

A. Generally, telehealth modifiers are intended for services provided within the United States. Billing for international services may not be reimbursed and could violate payer policies. Always check with the specific payer for their guidelines on international telehealth billing.

5. How do I handle telehealth billing for patients in different states?

A. Billing practices can vary by state due to differing Medicaid and commercial payer policies. It's crucial to familiarize yourself with each state's regulations and payer requirements to ensure accurate billing and reimbursement.

Latest Post

What Does Current Procedural Terminology Mean and Why Is It Important in Medical Coding?

How Does AI Reduce Denials and Boost Efficiency in Medical Billing?

DRG Validation in 2026: Why is it Essential for Hospitals?

EMR Conversion Challenges & Best Practices in 2026

CO 11 Denial Code: What It Means and How to Fix It

Related Post

Top Products

%201.png)